If your bank or credit union is looking to grow deposits, you’re not alone. Growing and retaining deposits is extremely high on the priority list for most financial institutions. Do you want to know where to find new deposits? You just have to know where to look!

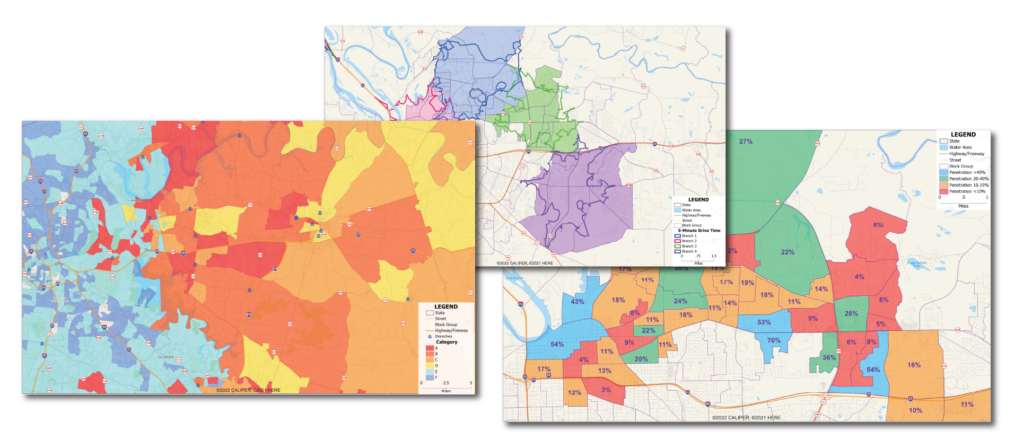

Doing an analysis of your current deposit customers can tell you a lot about where you’re likely to find new deposits. The first step is to identify what your high value depositors look like and where they live. Plotting your high-value deposit customers on a map can give you a clear view of where your high-value customer concentrations are and what types of communities these depositors live in. Once you have this information, you can look to find geographic areas that have a similar demographic breakdown to the areas where your strongest depositors are.

Targeted Direct Mail

– Purchase address lists of prospects within your target geography that match your ideal demographic criteria.

– Send them direct mail pieces highlighting your best offers and setting you apart from the competition.

Every Door Direct Mail (EDDM)

– While not as targeted as other direct mail methods, EDDM allows a cost-effective solution for direct mail by saving significantly on postage.

– You can select carrier routes and mail carriers will place one of your mailers in each mailbox along their route.

Geographically Targeted Digital

– Serve display ads and focus search ad budgets to maximize visibility in your geographic target.

– Digital can be a standalone tactic, but it works especially well as part of a multichannel campaign.

Implementing one or all of these tactics based on the analytical foundation you set will generate your best results. Some institutions may find it difficult to do this due to lack of bandwidth or lack of the diverse skillsets required to prepare and execute data-driven campaigns. That’s where Syntropy Group comes in – we have the experience to function as an extension of your marketing team and work alongside your team to help you accomplish your goals.

To learn more about how we can use our analytic marketing expertise to help you drive deposits, contact us at growth@syntropygroup.com to learn more.